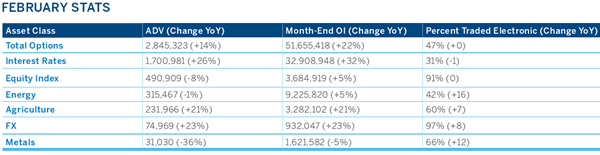

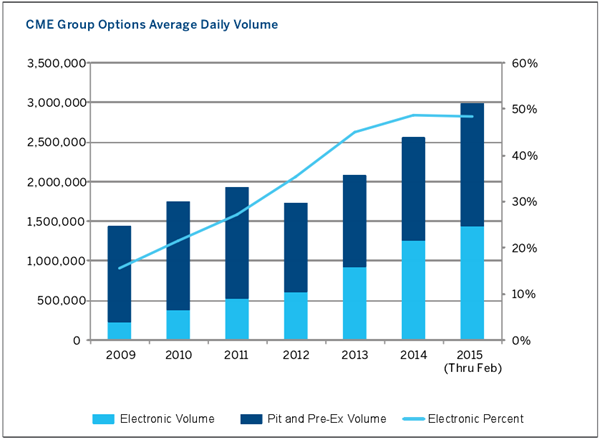

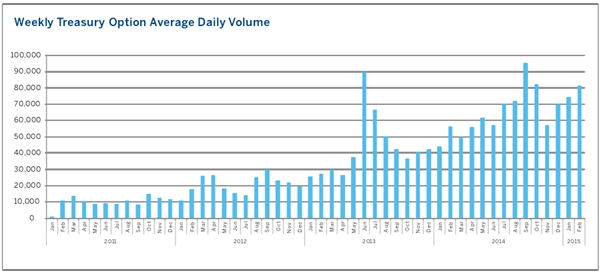

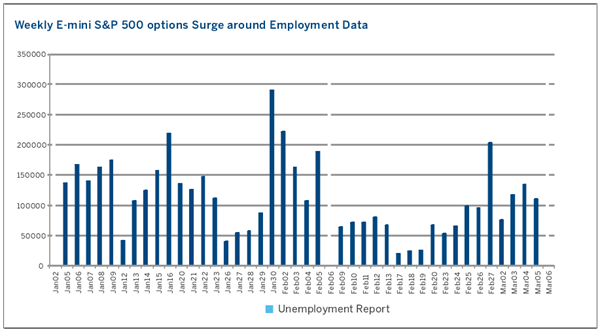

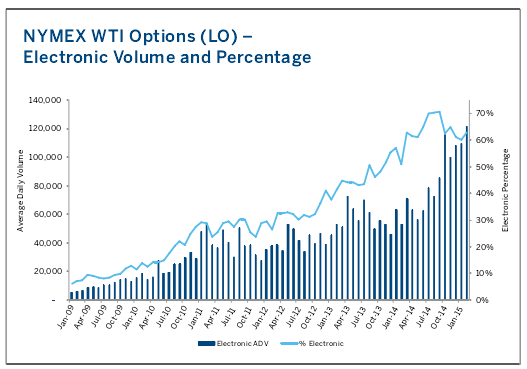

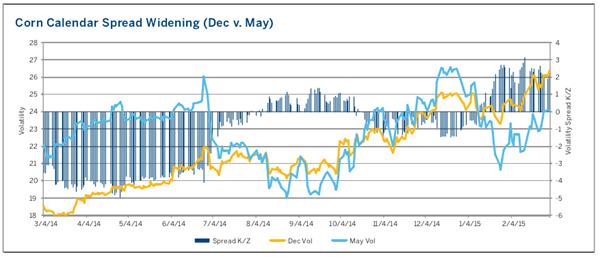

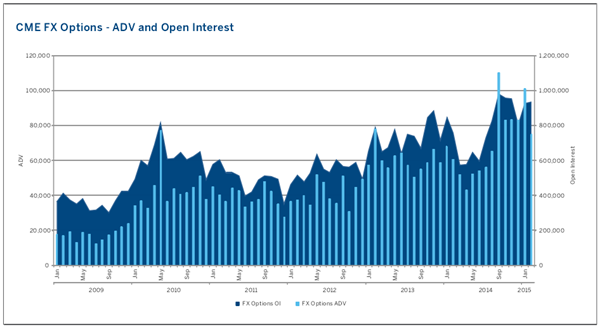

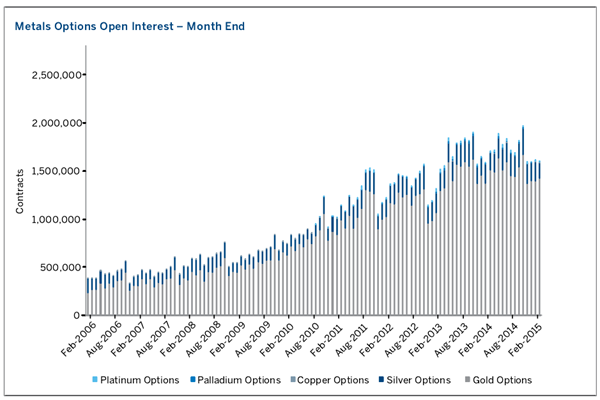

| Offering increased flexibility (strike, duration, exercise style) and precision, options on futures allow market participants to bettercustomize their risk management strategies to their specific needs. Plus, with 50% of options traded electronically, these productsare more accessible than ever.   INTEREST RATES OPTIONS Whether you trade on the floor or on the screen, CME Group Interest Rate options give you direct access to an array of products andan ever-expanding pool of liquidity — all in a streamlined and regulated marketplace. With the addition of Weekly Treasury options,the expansion of short dated Eurodollar Mid-Curve options and long-dated (Green) Eurodollar options, CME Group has significantlybroadened the range of Interest Rate option opportunities. Over 1 Million Eurodollar Options Traded Daily Eurodollar options traded 1,042,706 contracts per day,+47% YoY– Puts accounted for 68% of Eurodollar options volume Open interest finished February at 29.5 million, +36% YoY–66% of open interest is held in Puts. Mid-curve options represented 54% of the Eurodollar volume Electronic ADV was up 102% YoY, to 127,669 contracts per day Treasury Options Remain Steady 656,263 Treasury options traded daily, +3% YoY Activity in 2-Year note options remained strong with ADV of 12,238, +128% YoY– 72% of 2-Year note volume was in calls 10-Year note options: 408,088 ADV, -6% YoY 5-Year note options: 91,233 ADV, +11% YoY U.S. Treasury Bond: 62,941 ADV, +13% YoY Weekly Treasury options: 81,189 ADV, +45% YoY 60% of Treasury Options Traded on CME Globex 2-Year: 82% | Up from 50% in Feb 2014 5-Year: 58% | Up from 51% in Feb 2014 10-Year: 58% | Up from 57% in Feb 2014 30-Year: 66% | Down from 69% in Feb 2014 Fed Funds Options Gaining Momentum Ahead of Key FOMC Meetings Fed Funds Options represent a direct reflection of collective marketplace insight regarding the future course of FOMC monetary policy, and trading activity has surged in 2015: Fed Funds Options traded over 34,000 contracts during the second week of February, compared to 25,533 contracts in all of 2014. Fed Funds Options Q1 2015 ADV is 11 times Q1 2014 ADV. July 2015 Options trading increased with strategies centeredaround a June rate hike – (i.e. July 99.625-99.750 put 1x2). Puts accounted for 66% of Fed Funds Options volume  EQUITY INDEX OPTIONS With over 550,000 contracts traded daily YTD, CME Group Equity Index options on futures provide you with flexible, liquid tools to manage global equity exposure and pursue opportunities represented by the world’s leading indexes, all from one marketplace. On the floor or on the screen, large-cap to small-cap, short-term weekly, end-of-month to quarterly expirations, our extensive selection of products provides the choices you need to execute a variety of trading strategies. February Volume and Open Interest E-mini S&P 500: 441,038 ADV, -6% YoY – E-mini S&P 500 End-of-Month options: 57,192 ADV,+8% YoY – Open Interest in Weekly E-mini S&P 500 options increased 37% YoY to over 523,000 contracts S&P 500 options: 44,042 ADV, -2% YoY – S&P 500 End-of-Month options: 4,108 ADV, +2% YoY E-mini NASDAQ-100 options: 5,070 ADV, -70% YoY Weekly Options Update Weekly E-mini S&P 500 options: 105,398 ADV, +8% YoY – 315,980 contracts traded on Feb 6 around unemployment report – Weekly options represented 24% of the E-mini S&P 500 options volume in Feb – 75% of Weekly E-mini S&P 500 options Open Interest is held in Puts Weekly S&P 500 options: 4,737 ADV, -25% YoY Trading Trends Equity Index options: 62% Puts E-mini NASDAQ-100 options: 72% Puts S&P 500 options: 49% Puts E-mini S&P 500 options: 63% Puts 34% of volume was done via spread  ENERGY OPTIONS CME Group offers around-the-clock access to the world’s benchmark options products among Crude Oil, Natural Gas, and Refined Products. Our diverse options product slate provides the liquidity and open interest that traders need, with the flexibility to buy and sell American-Style, European-Style, Average Price, Calendar Spread, Short-Term, and Futures Strip options on three trading venues. Electronic Trading Up 63 Percent Energy options traded 315,467 contracts per day, -1% YoY Electronic ADV increased 63% YoY to 133,740 contracts per day. 42% of volume traded electronically on CME Globex Total open interest in Energy options reached 9.2 million at month-end, +5% YoY Crude Oil Options Crude Oil options traded 227,956 lots per day, +89% YoY. WTI options: 225,212 ADV, +92% YoY – 63% of the LO contract traded electronically on CME Globex – Record LO electronic ADV: 121,940 WTI 1 Month CSO: 8,317 ADV, +64% YoY WTI 1 Month CSO (Financial): 12,498 ADV, +218% YoY – Puts accounted for 89% of CSO (Financial) volume WTI Average Price options: 6,333 ADV, +183% YoY Crude Oil options RFQ activity remained strong. cmegroup.com/RFQ Weekly Options Continue to Gain Momentum Weekly Crude Oil options traded 901 contracts per day Offer precision to manage volatility arising from storage data, weather anomalies, and other macroeconomic factors, with the added benefit of shorter expirations to implement strategies at a lower premium. Natural Gas Financial Weekly options (LN1 – LN5) launched September 8 Weekly Brent options (BW1 – BW5) launched on August 18 All NYMEX weekly options are available for trading on ClearPort, Globex, and open outcry Natural Gas Options Nat Gas options: 79,533 ADV, -58% YoY Daily Natural Gas options (KD): 1,160 ADV, +91% YoY 12% of Natural Gas options were executed on CME Globex Puts accounts for 60% of volume Refined Product Options ULSD Physical option (OH): 4,556 ADV, +33% YoY ULSD Average Price option (AT): 812 ADV, +55% YoY Record Refined Product options electronic ADV: 975 Coal Options Coal options remained strong in Feb with ADV of 778, +87%YoY Energy Options on CME Direct CME Direct offers superior Energy options execution functionality Participation continues to grow with strong Globex energy option volume through CME Direct in February Learn more at cmegroup.com/direct  AGRICULTURE OPTIONS The diverse selection of CME Group Agricultural options offers the flexibility for effective risk management, as well as the ability to execute volatility strategies or event driven trades. The portfolio of Grain, Oilseed, Livestock and Dairy products provide an array of options, from outright and spread options (Calendar and Intercommodity Spread options) to short term alternatives (Weekly and Short-Dated New Crop options). Ag Options Continue to Outpace Futures Agricultural options traded 231,966 contracts per day,+21% YoY 60% of Agricultural options were executed electronically on CME Globex Options continued to outperform futures in February with YoY growth of +21%, while Futures were -6% YoY. Grains & Oilseeds Corn: 69,030 ADV, +5% YoY Wheat (SRW): Chicago SRW Wheat: 22,943 ADV, +15% YoY Wheat (HRW): 2,802 ADV, +748% YoY Soybeans: 80,144 ADV, +49% YoY Soybean Meal: 11,557 ADV, +15% YoY Soybean Oil: 6,865 ADV, -7% Short-Dated New Crop Meal and Oil options launched on Feb 23 Short-Dated New Crop options: 4,163 ADV, +48% YoY – Streaming 100 up, tight markets on Globex for Sorn and Soybean SDNC Weekly Options: 2,430 ADV, +153% YoY Lean Hogs volatility hits 10-year high of 42.5% Live Cattle options: 13,994 ADV, +23% YoY Lean Hog options: 12,737 ADV, -5% YoY Feeder Cattle options: 1,548 ADV, +80% YoY Dairy Class III Milk options: 1,683 ADV, 24% YoY – Calls accounted for 66% of Milk options volume Cheese CSC options: 304 ADV, +131% Trading Trends Puts accounted for 53% of February volume – Soybeans: 60% Puts – Feeder Cattle: 58% Puts – Corn: 49% Puts – Wheat: 50/50 Puts vs Calls  FX OPTIONS Trade FX options in the world’s premier FX marketplace. CME Group’s flexible products on major and emerging-market currencies provide greater capital efficiency, security, and unparalleled opportunity for managing FX exposure. That includes 31 FX options based on 22 currencies, offering enhanced trading versatility and the security of one of the world’s largest central counterparty (CCP) clearinghouses to mitigate counterparty risk. Volatility Continues to Drive Growth in FX Options Strong FX options traded 74,969 contracts per day, +23% YoY Record 96.6% of FX options traded electronically on CME Globex FX options open Interest jumped to 932,047 contracts,+23% YoY G10 Options +23% YoY EUR/USD options: 39,653 ADV, +85% YoY JPY/USD options: 10,437 ADV, +13% YoY GBP/USD options: 12,003 ADV, +11% MoM, -31% YoY CAD/USD options: 5,998 ADV, +20% YoY AUD/USD options: 5,853 ADV, -13% YoY Weekly Euro options Remain Strong EUR weekly: 7,109 ADV, +119% YoY GBP weekly: 2,396 ADV, +108% MoM, -63% YoY JPY weekly: 1,337 ADV, -4% YoY CAD weekly: 1,539 ADV, +87% YoY Trading Trends EUR/USD: 57% Puts GBP/USD: 56% Puts JPY/USD: 57% Puts CAD/USD: 50/50 Puts v Calls AUD/USD: 59% Puts  METALS OPTIONS The CME Group COMEX and NYMEX metals options suite gives market participant’s access to Short-Term Gold Options as well monthly Gold, Silver, Platinum, Palladium, Iron Ore, and Copper Options. All of our products are traded on three venues — CME Globex, CME ClearPort, and the New York trading floor, allowing for maximum access to liquidity for investors whenever they need it. Overview Metals options: 31,030 ADV, -36% YoY 66% of Metals options traded electronically on CME Globex Total open interest in Metal options was 1,621,582 at month-end Precious Metals Gold options: 25,029 ADV, -33% YoY – Open interest for gold options is split 78:22 (calls vs puts) Silver options: 5,068 ADV, -48% YoY – Open interest for Silver options is split 59:41 (calls vs puts) Platinum options: 389 ADV, +17% YoY – Calls accounted for 90% of Platinum options volume Base Metals Iron Ore options: 142 ADV, Flat YoY, Copper options: 180 ADV, +129% YoY Weekly Metals Options Weekly Gold options traded 100 lots per day Offer greater flexibility to manage the risk associated with government economic data, world events and other market-moving factors, with the added benefit of shorter expirations to gain market exposure at a lower premium. Available for Gold, Silver, and Copper options  THREE WAYS TO ACCESS On CME Globex The recent growth of electronic options markets has led to deeper, more diverse markets with easier entry and exit points, and more streamlined access for execution and clearing. 1,443,517 in daily liquidity Speed, transparency, access and liquidity of electronically traded markets Two-sided markets supported by dedicated market makers Request for Quote (RFQ) – Allows participants to get competitive quotes, even during times of low market activity. CME Direct’s complex options functionality allows you to send Request for Quotes on CME Globex. On the Floor 1,247,582 in daily liquidity Quick setup and nearly instant access to liquidity Voice brokers and floor traders facilitate price discovery and efficient execution on your behalf Bilaterally 289,022 in daily liquidity Control and convenience of privately negotiated trades Security and counterparty credit risk mitigation of CME Clearing 文中显示的任何交易代码仅作为演示计,并不代表推荐意图。 【附:盈透证券简介】  网开盈透做期货 佣金美刀两块多 股票期权和外汇 猛戳! ◆美国盈透证券是全美营收交易量最大的 顶尖混业互联网券商 ◆单一账户 多币种 直接接入全球24个国家100+市场中心,实现股票、期权、期货、外汇、债券、ETF及价差合约的全球配置 ◆超低手续费 美国期货及期货期权收费根据交易量阶梯式计算 盈透佣金0.25-0.85美元/手 ◆专业交易平台- 交易者工作站(TWS)、网络交易者及多种移动交易端选择,包括手机交易平台及iPad交易平台方便您随时随地把握市场走势并及时作出交易指令 ◆股东权益50亿美元 标普信用评级A- 展望稳定, 明显优于许多国际知名金融机构  ◆连续三年荣获美国主流专业投资期刊BARRON’S的最佳网络经纪商 》最适合期权交易者 》 最佳投资组合分析及报告 》最佳交易体验及交易技术 》 最低保证金借贷成本 》全球交易者最佳券商 》 10年连续最低成本券商 》频繁交易者最佳券商 》 最佳综合奖 ◆根据不同客户需求 支持多种账户类型 包括对冲基金、职业/非职业顾问、自营交易商及白标经纪商账户 欲了解更多信息请美国盈透证券官方网站:www.ibkr.com.cn/7hcn 或直接联系销售经理边嘉茵深入了解个人账户及机构账户的相关服务: 有【设立境外基金产品】需求的朋友也可以和边嘉茵联系: 手机:l39ll47336O 邮件: abian(a)ibkr.com 电话:+852 2156 79l5 美国盈透证券有限公司是 NYSE-FINRA-SIPC成员,并受美国证券交易委员会(SEC)和商品期货交易委员会(CFTC)监管 责任编辑:叶晓丹 |

【免责声明】本文仅代表作者本人观点,与本网站无关。本网站对文中陈述、观点判断保持中立,不对所包含内容的准确性、可靠性或完整性提供任何明示或暗示的保证。请读者仅作参考,并请自行承担全部责任。

本网站凡是注明“来源:七禾网”的文章均为七禾网 www.7hcn.com版权所有,相关网站或媒体若要转载须经七禾网同意0571-88212938,并注明出处。若本网站相关内容涉及到其他媒体或公司的版权,请联系0571-88212938,我们将及时调整或删除。

七禾研究中心负责人:刘健伟/翁建平

电话:0571-88212938

Email:57124514@qq.com

七禾科技中心负责人:李贺/相升澳

电话:15068166275

Email:1573338006@qq.com

七禾产业中心负责人:果圆/王婷

电话:18258198313

七禾研究员:唐正璐/李烨

电话:0571-88212938

Email:7hcn@163.com

七禾财富管理中心

电话:13732204374(微信同号)

电话:18657157586(微信同号)

七禾网 |  沈良宏观 |  七禾调研 |  价值投资君 |  七禾网APP安卓&鸿蒙 |  七禾网APP苹果 |  七禾网投顾平台 |  傅海棠自媒体 |  沈良自媒体 |

© 七禾网 浙ICP备09012462号-1 浙公网安备 33010802010119号 增值电信业务经营许可证[浙B2-20110481] 广播电视节目制作经营许可证[浙字第05637号]